We like to show a lot of cool maps on this site, but this one may leave you feeling either really fortunate or a little freaked out. The National Low Income Housing Coalition just issued a new report showing how much you need to make on average to afford an apartment in each state in America.

Videos by Wide Open Country

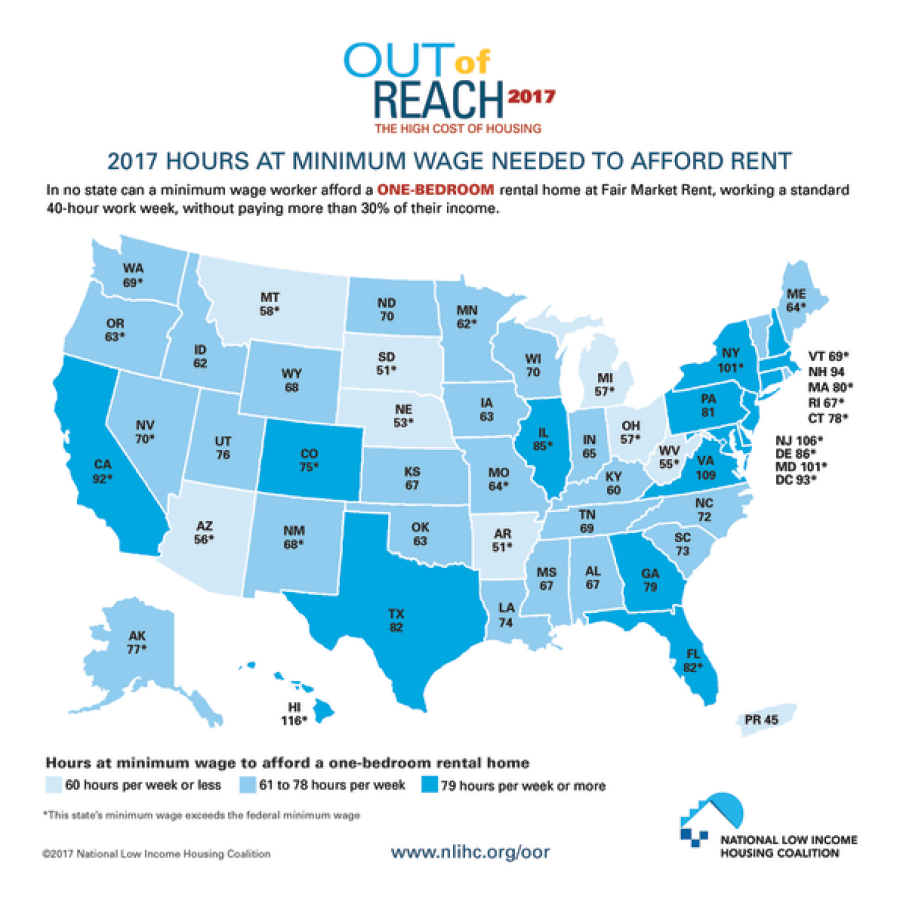

"Affordable housing" in the United States means you can live there without spending more than 30% of your income. No surprise, but "minimum wage" simply doesn't cut it when it comes to even the most basic living conditions. In fact, in 99% of counties you can't live affordably off a full time minimum wage job.

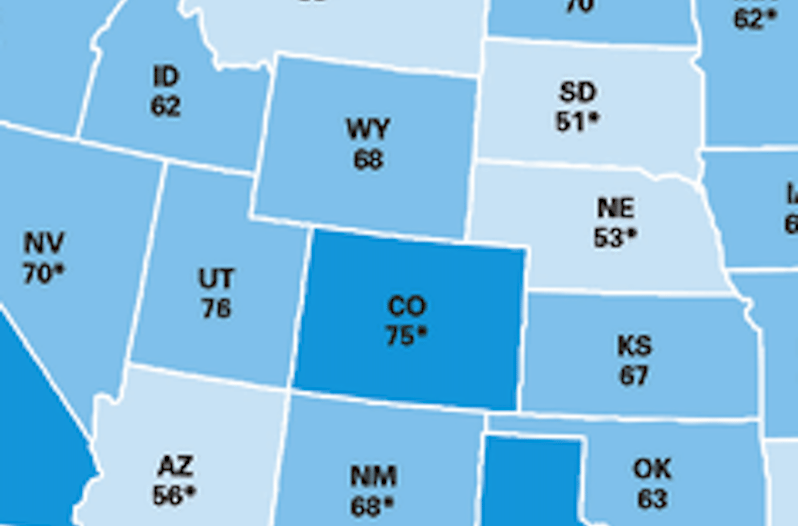

This map shows just how many minimum wage hours you need to work in order to afford an average one bedroom apartment. And that's just an average, which doesn't account for the fact most people live in cities compared to more affordable rural areas.

Fair warning: it's not pretty. In Texas, you need to work an 82-hour week just to afford an apartment. That number ranks among the highest.

National Low Income Housing Coalition

As you can see, most of those numbers just aren't feasible. Who can work 109 hours a week to live in Virginia? Others eclipsing the 100-hour mark include New York, Maryland, New Jersey and Hawaii, which clocks in at a whopping 116 hours.

Even the most affordable American state South Dakota has you working 51 hours per week. Puerto Rico is the closest to reasonable at 45 hours.

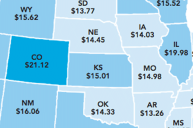

A second map is equally discouraging. This one shows how much you need to make per hour in order to afford a two-bedroom apartment. In other words, just enough room for a very small family. Working 40 hours per week for 52 weeks.

READ MORE: Map Shows the Most Misspelled Words in Each State

Most wages are nearly twice the federal minimum wage. The least money for a state? Arkansas at $13.72 an hour. The most? Hawaii at $35.20.

On average, somebody needs to make $21.21 per hour to afford a two-bedroom apartment in the United States. For one bedroom? $17.14. The mean wage in America is $16.38.

As Fast Company points out, the issue doesn't just pertain to cost. The U.S. government spends around $200 billion per year on housing subsidies. But most of that goes to wealthier Americans. In fact, 75% goes to families who earn more than $200,000 per year in order to subsidize their mortgages.

Comparatively, 20 million Americans live in "housing poverty." That means they can't afford basic needs like food and medical services after paying for their housing.